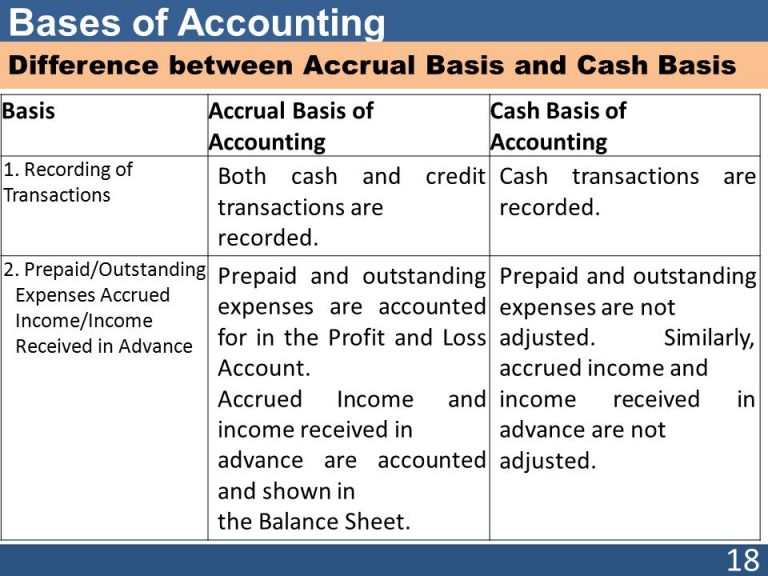

Public companies reporting their financial positions use either US generally accepted accounting principles ( GAAP) or International Financial Reporting Standards (IFRS), as allowed under the Securities and Exchange Commission (SEC) regulations. Cash accounting is far simpler to track than accrual-basis accounting. For example, as you saw above, Chris measured the performance of her landscaping business for the month of August using cash flows. Cash-basis accounting sometimes impacts the timing of revenue and expense reporting until cash receipts or outlays occur. Would she have to increase her sales exponentially in order to start bringing in a decent profit each month?Īs you move through the chapter, you’ll get to see the impact of the two methods of accounting and how these methods impact the insights and decisions Chris made for her new business.Ĭash-basis accounting is a method of accounting in which transactions are not recorded in the financial statements until there is an exchange of cash. But after deducting her expenses, she had only $250 left, so she worried about the future of her business. She brought in $1,400 in revenue in her first month, which she felt was substantial given that it was her first month. This means that she simply recorded the cash that came in and the cash that went out of her business. Most small start-up companies use the cash method of accounting because it is easy to understand, requires no special training, and helps them focus on one big key to their survival-cash. Chris just finished the first month of her landscaping business operations at the end of August, and she used the cash method of accounting to figure out her net income. In this chapter, you’ll explore both methods, see how each impacts financial statements differently, note the role of timing in each method, and learn how and when to record capital and expense transactions. This method is used by most publicly traded companies. Using the accrual method, we match cash inflows and the outflows required to generate them.

The other method, called the accrual method, records transactions when they occur, rather than waiting for cash to be accumulated. This method is most commonly used by small businesses that deal primarily in cash transactions. We track cash inflows and outflows as they occur. The cash method is just as the name implies-it records transactions only when cash flows. In fact, it’s so important that it dictates one of two ways we can account for our business transactions. In business, cash is certainly important. Some private companies may choose to use cash-basis accounting rather than accrual-basis accounting to report financial information. In this section, we will explore the basic elements of cash and accrual accounting and the businesses that are most likely to use each one.

Accrual accounting matching principle professional#

Sole proprietorships, professional firms, such as accountancies and law firms, and small services companies normally use a cash-basis accounting system.Īccrual accounting relies on accounting recognition of transactions and event. The cash basis of accounting considers the realization of – and the resulting cash flow from – a transition or event. Realization = Cash Flow Due to a Transaction or Event Recognition = Recording of a Transaction or Event Whereas recognition is the act of recording a business transaction or event, realization establishes the completion of the earning process and is synonymous with cash inflow or outflow. Realization is the process of converting noncash resources and rights into money, which is achieved through the sale of an asset for cash or converting claims to cash. Recognition is the process of formally recording a business transaction or event in an entity’s financial accounting records. Both US GAAP and IFRS require that financial statements be prepared on the accrual basis of accounting.Īccrual accounting relies on the revenue recognition and the matching principles, which consider the timing of the recognition of business transactions and events. Accrual basis of accounting recognizes revenues, expenses, gains and losses and the related increase or decrease in assets and liabilities in the period when the accounting event occurs.

0 kommentar(er)

0 kommentar(er)